2008 and they have learnt nothing – Goldman Sachs

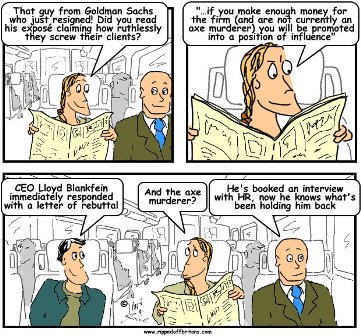

If there is one news story I would ask every UNISON to read then it is the story that broke earlier this week about a senior figure working for Goldman Sachs who had his resignation letter published in the New York Times. It is of massive interest is the connection of Goldman Sachs with a number of catastrophic financial failures including the Greek Debt crisis? At a time when we are told that we need to accept the deficit and accept less money, less services, more misery, it appears that the whole financial system has learnt nothing. Please find a number of high profile articles of the subject of Goldman Sachs and their connection with the Greek Debt Crisis.

1. TIME Magazine “ 7 Ways of Seeing Goldman Sachs”

The article in the TIME magazine see link below refers to another article by James Shaft of Reuters argues along similar lines, saying that financial markets don’t operate properly without strict regulation, and that pining for the days when banks took the long view misrepresents the past. It wasn’t because investment banks weren’t publicly traded or that bankers of 40 years ago had more scruples, he argues, but that heavy regulation prevented the kind of excesses that investment banks engage in now.

2. “Goldman Sachs shares slump”

3. “Goldman Secret Greece Loan Shows Two Sinners as Client Unravels”

According to the article below Goldman Sachs appears to have used a clever financial instrument to disguise the Greek Governments growing debt burden

“As first reported in 2003, Goldman Sachs used a fictitious, historical exchange rate in the swaps to make about 2 percent of Greece’s debt disappear from its national accounts. To repay the 2.8 billion euros it borrowed from the bank, Greece entered into a separate swap contract tied to interest-rate swings.”

4. “Toxic bank Goldman”

http://www.mirror.co.uk/news/uk-news/toxic-bank-goldman-sachs-web-763345

5. Goldman Sachs involved in the Greek debt crisis watch this YouTube clip http://www.youtube.com/watch?v=07-hA9DW-Po

Questions:

“In light of this story breaking what should the Regulators do about Goldman Sachs?”

“Should those people who lost out as a result of Goldman Sachs advice now consider putting in a claim for losses from Goldman Sachs?”