The following report has been produced by the PCS trade union in response to the latest proposal to cut posts. The report provides an analysis and data on a major income deficit (£123 Billion a year) which in the current financial climate you would think a responsible government should be addressing. Instead they are targeting Benefit Fraud (£1.5bn a year).

Report begins:

The financial crisis was not caused by excessive public spending. That is vital to bear in mind when we hear all around us that the ‘deficit’ must be cut.

This is not a spending crisis this is an income crisis.

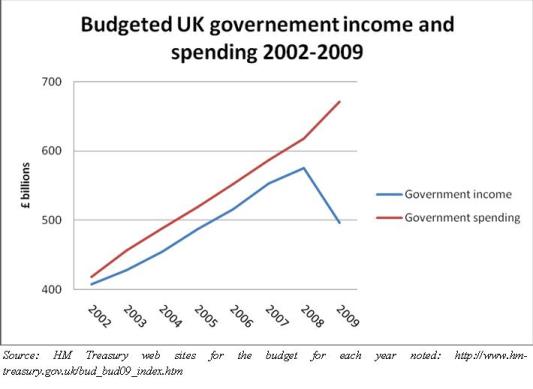

In the above chart the ‘deficit’ is the gap or difference between what the government spends (the top line in the chart) and what it receives in income (shown on the bottom line of the chart). That deficit for this year was originally estimated to be £178 Billion. That original estimate has now been revised using more up to date figures and is now estimated to be £156 Billion. A difference between the two estimates of £22 Billion.

The lack of tax revenue did not cause the current financial crisis. The reason for that substantial fall in government income you can see on the chart in 2008 was as a result of the downturn in economic activity – the recession sparked by the near collapse of the worlds banking system. Bailing out the banks in the UK cost £1.3 Trillion, which is 1,300 Billion pounds. The recession increased unemployment and hit tax revenues.

What the Con Dem government don’t want to talk about is the Tax Gap.

That is the difference between what the government would receive in tax if everyone paid what they should pay and what it actually receives. The difference between what it should receive and what it actually receives is the tax gap; estimates from the PCS union indicate the gap to be £123 Billion, which is 123,000 million pounds.

I repeat that figure again because members are being bombarded by anti-public services propaganda every day.

Tax Gap £123 Billion

PCS asked Richard Murphy a Chartered Accountant and a Tax expert to research and calculate the size of the tax gap. That research has now been published and the tax gap is estimated at £123 Billion, which is 123,000 million pounds per year.

That £123 Billion is made up of three amounts:

· £25 Billion avoided.

· £70 Billion evaded.

· £28 Billion not collected.

The difference between tax avoidance and tax evasion is as Denis Healy once said “the thickness of a prison wall”. Tax is avoided by exploiting loopholes in tax law.

The TUC pamphlet “The missing Billions” estimates that £25 Billion each year is avoided by corporations and rich individuals. The pamphlet gives examples of some of the measures used to avoid tax.

One well known example is the tax avoidance used by rich individuals running private equity firms who by classifying their income as capital gains pay 22% less tax than they would otherwise pay if they declared it as income and were subject to income tax at the top rate. Hence one multi-millionaire private equity partner admitted that he paid less tax than his cleaner. The reason for this was, at the time, Capital Gains Tax stood at a rate of 18% whereas the top rate of income tax stood at 40%, a difference of 22%. In his budget speech on 22 June George Osborne said,

“Some of the richest people in this country have been able to pay less tax than the people who clean for them.

That is not fair – and it stems from the avoidance activity that has exploited the wider gap between the rate of Capital Gains Tax and the top rates of income tax.

These practices are costing other taxpayers over £1 Billion every year”

And he raised Capital Gains Tax from 18% to 28%. Great you may think. However, what he did not point out was that the top rate of income tax is now 50%, so with Capital Gains Tax now at 28% the gap between the two is still 22%. Those richest people in the country will still be exploiting that loophole.

£70 Billion Tax evaded

The Richard Murphy report estimates tax evaded to be £70 Billion. The report shows why the official HMRC estimate of tax avoided and evaded totalling £40 Billion is way too low particularly for tax evaded. This is because HMRC concentrates its efforts on those who do make tax returns and ignore the significant elements in society who evade the system altogether. By definition tax evasion is a criminal offence and (surprise, surprise) those evading tax do not tell HMRC about their activities. By relying on data supplied to HMRC they are missing the evasion that is completely outside the tax system.

However, for indirect taxes such as VAT, HMRC employs a ‘top-down’ approach. The gap is estimated by comparing the net theoretical tax yield, which involves assessing the total amount of expenditure in the economy that is liable to VAT, with actual VAT receipts. The difference is the VAT gap. This approach is rational because it seeks to establish the likely tax due independent of data submitted to HMRC. This ‘top- down’ method is the approach adopted by Richard Murphy in his report.

An example of tax evasion was demonstrated in a recent criminal case where an organised gang were convicted of defrauding HMRC of £4.5 Million. They submitted refund claims in the names of fictitious migrant labourers claiming they had overpaid income tax. Now at this point you may think that there is a bit of a flaw in this cunning plan. Given that the details provided to HMRC are for people who don’t actually exist, and haven’t actually paid any income tax, how can they get a refund on tax they haven’t paid? Not a problem. HMRC made the repayments without checking, the gang got £4.5 million from HMRC. This is because HMRC adopted the attitude of ‘pay now, check later’. The judge Christopher Hardy in sentencing the gang also raised concerns about HMRC’s system, “Trust has become a very risky and unwise basis in this day and age with which to disperse millions of pounds of public money”

We agree with the judge. Hence one of the recommendations in the Richard Murphy report is that HMRC should engage staff to check tax repayments before they are made. This isn’t rocket science.

£28 Billion Tax not collected

This is not an estimate. It is the published figure from HMRC as at 31 March 2010 for monies that have been declared or assessed but not paid to HMRC. That debt does not come in by magic and HMRC employs part of its workforce in the Debt Management and Banking section. A section that has also been cut, in the HMRC drive to close offices and reduce its staffing.

Richard Murphys report and PCS say:-

· More staff should be employed to tackle tax avoidance.

· More staff should be employed to tackle tax evasion.

· More staff should be employed to recover tax not collected.

· We want tax justice. We all have to pay our tax. The banks, the big corporations, the super rich and the criminals should pay their tax too.

End.