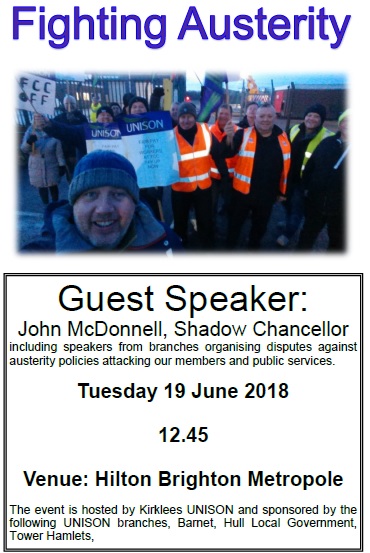

Category: Austerity

Barnet Council Armageddon Budget: “Our Four Demands”

Advice for Waste & Recycling members

Pay advice for Street Scene members

There continue to be serious issues with payments for some staff working in Street Scene.

To view advice to members please click on link 2018.06.14. Pay issues leaflet

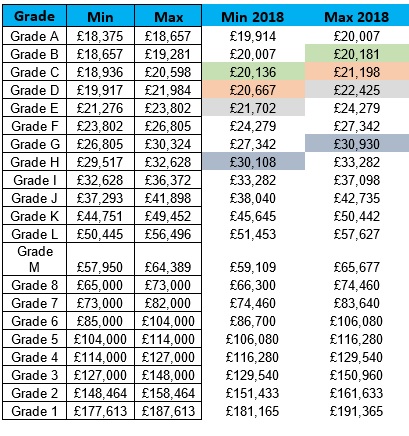

National Pay impact on Barnet Council grades

The above table shows the news grades following the National Agreement of Pay.

Barnet Council will be paying the National Pay Award in the Pay Slip at the end of June.

It should include your new basic pay rate and three months backdating to 1 April 2018.

For those staff who are no longer Council employers but who are entitled to the Pay Award here is the link to the London Agreement which has the spinal column points.

If you have any problems with your pay please contact the Barnet UNISON office on 0208 359 2088 or email contactus@barnetunison.org.uk

#BarnetFundingCrisis video – Choices

#FundingCrisis at Barnet Council

1. Background

1. Background

Some of us have been working in Barnet Council a long long time so it’s hard to believe that almost 6 years ago Barnet Council announced the ‘Barnet Graph of Doom’

https://www.theguardian.com/society/2012/may/15/graph-doom-social-care-services-barnet

they even made a video https://youtu.be/2lC1DWzHFHg

A lot has happened in that time.

The Council looked to mass outsourcing as an option and by late 2014 had plans for outsourcing almost all of the Council, just like Northamptonshire County Council.

Barnet Council pulled back from further outsourcing but Northamptonshire County Council ploughed ahead and the rest as they say is history……..

“Northamptonshire in early February became the first council to issue the first section 114 notice of its kind in 20 years, barring new spending on all but statutory services.”

https://www.publicfinance.co.uk/news/2018/02/northants-revised-budget-finds-further-ps99m-savings1

Some of us anoraks do keep an eye on the Council and I plead guilty to being one of those anoraks.

The financial viability of the Council has a direct impact on Barnet UNISON members working for the Council and the contractors delivering services for the residents of Barnet.

The “Barnet Graph of Doom” has always been in my thoughts as we approach the end of this decade. My concern about the doomsday scenario was not helped with the lack of any serious media coverage during the last local government elections. Funding from central government continues to diminish yet demand for services is increasing. The idea that business rates will help offset the loss of government funding is in my view both pure fantasy and dangerous. Anyone venturing outside the Westminster bubble will see the relentless decline of high streets and the economy. Not a week goes by without hearing that another retailer is going bust and often these are based in the big malls not the high streets. Austerity is draining the life force not just out of public services, but our communities and local businesses. After all if you have no money, you can’t spend it.

What Financial Crisis?

On Monday 11 June 2018, at the Policy and Resources Committee a very serious financial crisis is being brought to councillors.

To view the details click on the links to the three reports below

Business Planning report here http://barnet.moderngov.co.uk/documents/s46601/Business%20Planning.pdf

Medium Term Financial Strategy (MTFS) report here http://barnet.moderngov.co.uk/documents/s46602/Appendix%20A%20-%20MTFS.pdf

Title Contract variations and extensions

http://barnet.moderngov.co.uk/documents/s46586/Contract%20Variations%20and%20Extensions.pdf

A jargon free analysis has been provided by Barnet Blogger Mr Reasonable has already provided his views on what he has read in the above reports which you can view here.

http://reasonablenewbarnet.blogspot.com/2018/06/financial-meltdown-in-barnet-should-we.html

2. Back to the Business Planning report

The report has a lot of worrying news as it appears that the final prediction of the Barnet “graph of doom” may have arrived a lot earlier than had been predicted.

As a result of the seriousness of the content of the report Barnet UNISON has already met with the Chief Executive and the section 151 officer at which we were able to raise our concerns.

Our first concern is the “in year saving of 9.5 million that has just suddenly appeared from nowhere.

By that I mean, when the latest Council Budget was approved on Tuesday 6 March 2018, there was no forecast for any need for any more budget cuts.

See MTFS here

Yet in the MTFS for Policy and Resources Monday 11 June 2018 it reveals:

“Budget Gap after savings £13.493 million”

Barnet Council have taken £4million from reserves to reduce the Budget Gap to £9.453 million.

(Source: http://barnet.moderngov.co.uk/documents/s46602/Appendix%20A%20-%20MTFS.pdf )

It’s important to understand what this means.

For 2018/19 Barnet Council has already, consulted and made plans to make £8.989 in cuts.

The latest MTFS is now urgently requiring the Council to find a further £9.453 million which would mean a total of £18.442 million in service cuts.

This is a #FundingCrisis.

Barnet UNISON has asked where the £9.453 million cuts for this year will be made.

However, the situation gets worse.

In the MTFS in March 2018, Barnet Councillors agreed a budget that stated that for the period 2019/20 they would need to find an extra £5.965 million of cuts on top of the already £12.174 million of cuts planned for 2019/20.

That would mean £18.139 million of cuts for 2019/2020 would be made to services.

However the MTFS for June 2018 reveals that the £5.965 budget gap has now increased to £22.997 million of cuts.

The Council plans to provide £3.720 from reserves meaning the revised extra cut needed for 2019/20 is £19.277 million.

This means the revised figure for the total amount of cuts required for 2019/2020 has increased from £18.139 million to £31.451 million.

Sadly it get worse.

For 2020/21 the MTFS is projecting a £34.334 million cut

For 2021/22 the MTFS is projecting a £41.994 million cut

“The updated MTFS shows an anticipated budget gap of £42m to 2021/22. High level calculations estimate this to be £62m when extended out to 2024/2025.”

(source: paragraph 1.1.8 Business Planning 2018-24, 11 June, 2018)

3. Communication

We have been advised that news of the #FundingCrisis is being cascaded down to the workforce.

4. What can the Council do?

Whilst the bigger issue of government funding needs to be addressed outside Barnet, Barnet UNISON has views on some of the choices that the Council needs to consider in order to prevent any further cuts to frontline services in the short term.

Our suggestions are based on a number of factors

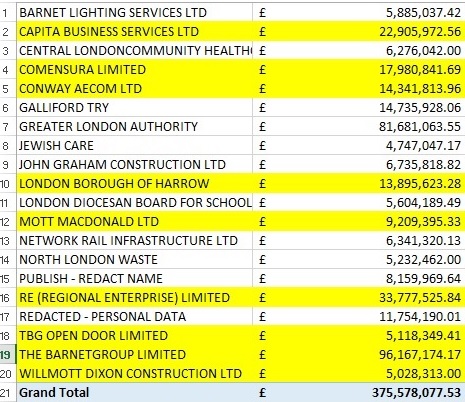

The latest Council spend.

We have looked at what the Council has spent for the period April 2017 to March 2018 which includes spend to the contractors. The Barnet Council data was downloaded from their website here:

https://open.barnet.gov.uk/dataset/expenditure-reporting-2017-18

From this data we have collated a table of the Top 20 spend (see table)

Barnet UNISON savings proposals

- Non-essential locums/consultants.

It is an established fact that the agency/consultancy spend spiralled out of control after 2011 as the outsourcing began. The culture of dependency on consultancy is draining much needed money from frontline services. An urgent review of all non-essential locum posts must be completed as a matter of urgency.

- Contractors

Barnet Council must begin process of terminating of outsourced contracts over a phased period of time. It is unsustainable to see in-house budgets squeezed whilst outsourced services are making money from the public purse.

- Capita CSG

- Re

- Mott MacDonald,

- ISS

- NSL

- Bring Barnet Group back into the Council

The Council is in a financial crisis which is not getting better any time soon. Frontline services which help and support the most vulnerable are going to be at risk.

The Housing Service needs to be brought back under Council control. The decision makers need to decide whether there is financial and moral justification to continue to finance senior management structures both within and outside the Council, for example, there is a Chief Executive post in Barnet Homes and Barnet Council, to have both is not sustainable or defensible under the current economic climate. It is our view that by returning Housing Services back into the Council there would need to be a review of the senior management structure which would inevitably lead to some serious savings thus avoiding the need to make cuts to frontline services.

- Commissioning Service (client side)

The implications of our previous options would mean the Commissioning service would cease to exist – this would lead to a significant budget saving. The current revenue budget for this service is approximately £7 million a year.

Conclusions

The cuts to Council funding are part of the austerity anti public services agenda which are ultimately a deliberate attack on local democracy.

Councils are the heartbeat of our communities. They are a vital part of the public service infrastructure that exists to support and promote wellbeing in our communities.

The damage resulting from Austerity policies is becoming clearer every day whether it is the increase in homelessness, closure of shops in the high streets, increase in begging, increase in fly tips, longer waiting times in the GP or hospitals.

In the absence of a “Magic Money Tree”, something needs to change here in Barnet.

The Council needs to hold up its hands, and step away from the previous ideology that has dominated decision making over the last decade.

In our view, with the #FinancialCrisis now in black and white, decisions must now be made on what to fund or not.

We believe the options provided above will provide a “breathing space” for frontline services.

Our proposals will not be enough in the medium to long term. That can only be addressed by national government.

In the absence of any sign that the Government are going to reverse the cuts to Councils, it must be time that that all Councils join the Trade Unions, workforce and residents and march on Parliament to demand proper funding for our communities.

“We Want To Get It Right This Time, Don’t We?” Barnet UNISON Family Services report

Recommendations

- Extend formal staff consultation by at least 1 month

- Request for an update of progress and developments following the consultation to come to this Committee prior to it going to General Purpose Committee (formerly GFC) and bring to this Committee hard data regarding the changes proposed here.

- Ensure the trade unions and staff are fully engaged with all aspects of the restructure including any changes to role profiles and that the trade unions are formally involved in the job evaluation process.

- Engage staff fully in the development and design of the new services before the consultation of the restructure takes place. Amongst other concerns there are significant Health and Safety considerations for staff and the public regarding the changing usage of some of the premises mentioned in this report.

To view full report click on link Barnet UNISON Response to Children, Young People and Family Hubs 0-19 FBC 2018

Barnet Council: “Listen to Street Scene workforce”

Barnet UNISON: Response to Street Scene Operational Changes 2018-19

Barnet UNISON Recommendations:

To ensure the successful implementation of the reorganisation of the recycling and refuse services Barnet UNISON seeks the support of the Environment Committee to implement the following:

- Street Scene workforce and Barnet UNISON must have a direct involvement/engagement in any proposed changes to the service.

- One central depot for the whole workforce.

- No cuts to frontline workforce: A recognition that by increasing the size of the population of the borough ultimately means the workforce and fleet must grow.

- Pay: An immediate and timely investigation into the systemic pay roll issues for Street Scene workforce is conducted in order to restore the trust, confidence and morale of the workforce.

- A programme for the replacement of ageing fleet to commence.

To view full report click link 2018.06.01 UNISON Response FINAL