Category: Local

Branch campaigns

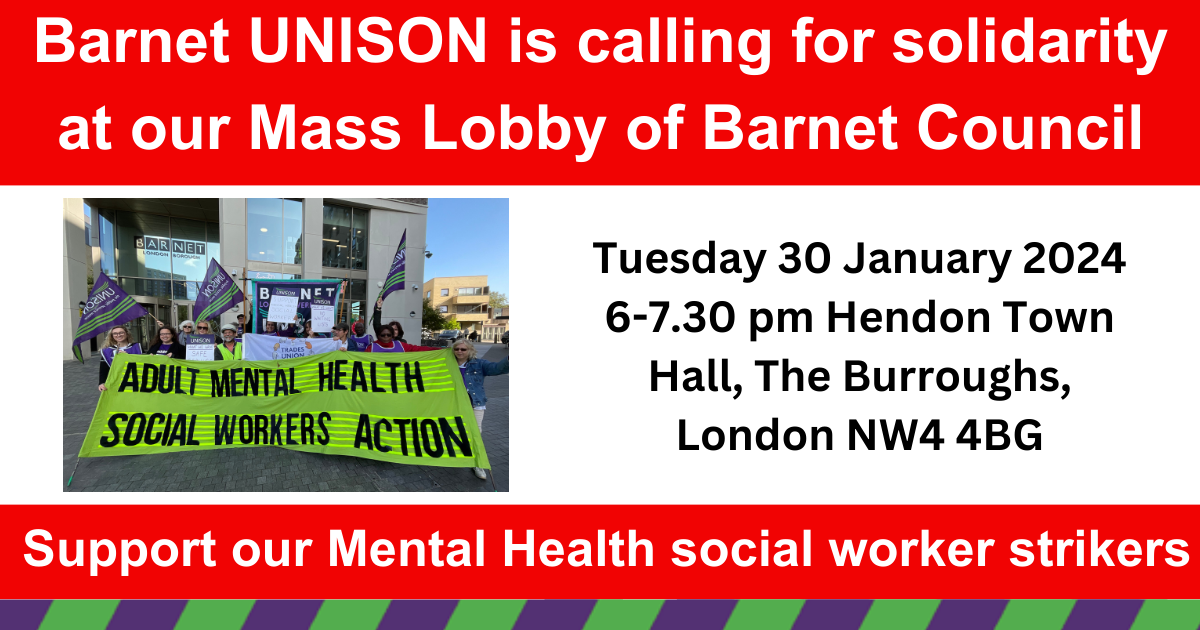

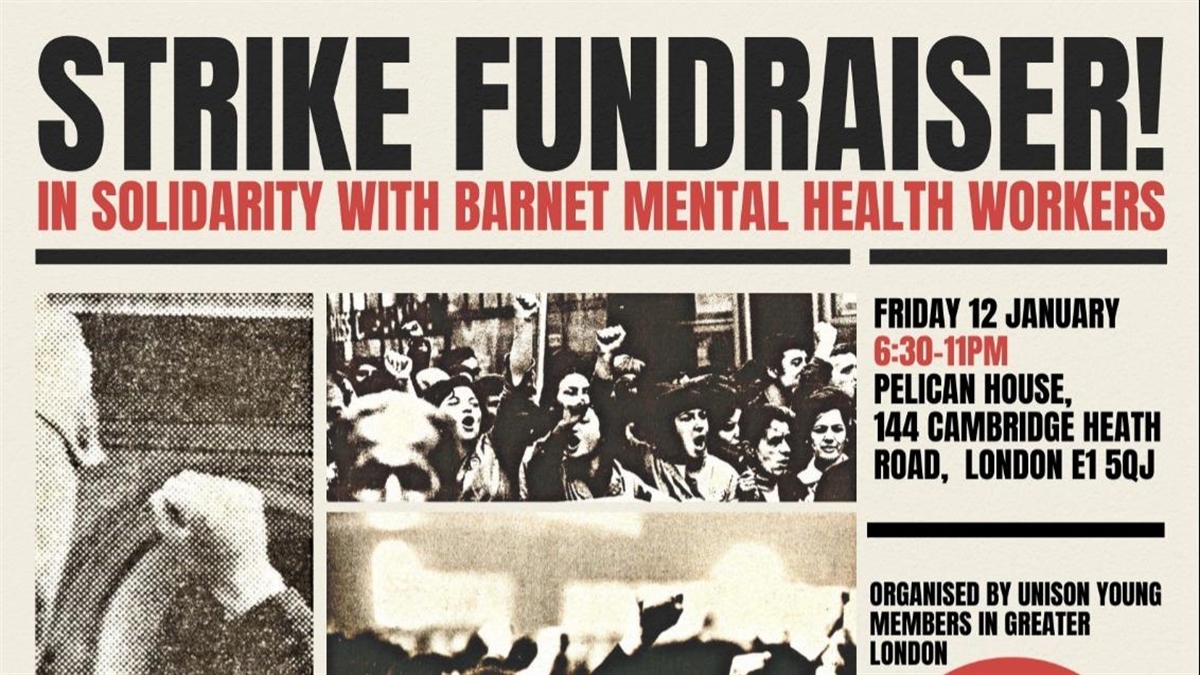

Come along to Solidarity Fundraiser for Mental Health social work strikers 12 Jan

I want to give a big thanks to UNISON Young Members – Greater London Region for organising a “Strike Fundraiser for Barnet Mental Health Workers!” It is truly both humbling and inspiring that our UNISON Young Members are prepared to take the time to organise this event. (John Burgess Branch Secretary Barnet UNISON).

Please click on link to register.

https://www.outsavvy.com/event/17466/strike-fundraiser-for-barnet-mental-health-workers

Read about details below.

Our comrades, the Mental Health Workers at Barnet Council, have been on strike over poor pay and dangerous working conditions that put the lives of the people they care for at risk. There were also new colleagues who wanted to join the strike but council management has blocked members from taking action. We commend our brave comrades and Unison Young Members – Greater London Region are hosting this fundraiser to support them whilst on strike.

Join us at Pelican House, 144 Cambridge Heath Road and expect some great music with live DJ’s, a raffle and some cheap food and drinks.Event kicks off at 6:30pm until 11pm. Let’s party and dance in solidarity with the brave strikers! 💃

Tickets are £7 advance and £10 at the door.

Striking workers go free! ALL funds going to directly to strike relief fund.

The event space has level access. There is a gender neutral accessible bathroom available for use directly next to the event space which does not require a radar key.

There is no parking at the event space, the nearest Blue Badge parking is on Parmiter Street, approximately 965 metres away, where there are 2 on street bays, with a 3hr maximum. We can open the gate to let a car through with advance notice, but it is not normally possible to park a car there for the duration of an event.

Hasta la victoria siempre!! ✊

Organised By UNISON Young Members – Greater London Region

Organiser of Strike Fundraiser for Barnet Mental Health Workers!

Day 16 Mental Health social worker strike

To view full flyer click on link below

https://www.barnetunison.me.uk/wp/wp-content/uploads/2023/12/2023.11.27-Day-16-strike-leaflet.pdf

Join Barnet UNISON Festive picket line

Yo Ho Ho: Join Barnet UNISON Festive Mental Health social worker picket line

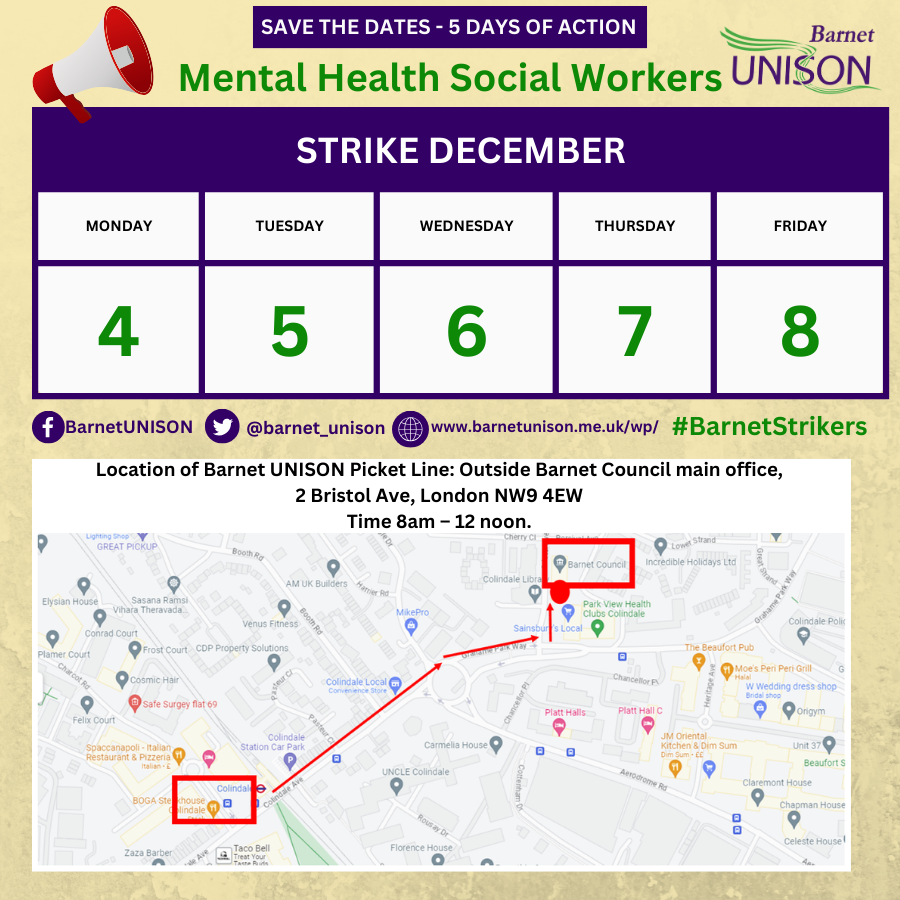

Barnet UNISON Mental Health social workers begin a week of strike action on Monday 4 December.

Please see details of the location and times of our picket line.

What can supporters do?

1. Visit our picket lines all week commencing 4 December to 8 December

between 8- 12.30 pm (see attached graphic).

2. Please sign #BarnetUNISON email campaign to Barnet Council Chief Executive Please click on the link and follow the instructions. https://action.unison.org.uk/page/135744/action/1 Let us know when he replies.

Please send a solidarity message to our strikers by emailing our office at contactus@barnetunison.org.uk

3. If you are on social media, you can help by liking/sharing or commenting on our many posts. Here are our social media sites.

Twitter: https://twitter.com/barnet_unison

Facebook: https://www.facebook.com/BarnetUNISON

Instagram: https://www.instagram.com/barnetunison/

4. Please write by email or by letter to:

John Hooton, Chief Executive of Barnet Council John.Hooton@Barnet.gov.uk

Address: London Borough of Barnet; 2 Bristol Avenue; London NW9 4EW

Cllr Barry Rawlings, Leader of Barnet Council Cllr.B.Rawlings@barnet.gov.uk

Address: London Borough of Barnet; 2 Bristol Avenue; London NW9 4EW.

Solidarity

Barnet UNISON.

End.

Background:

- Open letter to Executive Director of Adult Social Care – Mental Health social work dispute.

- Open letter to Director of Adult Social Care – Mental Health social work dispute.

- Open letter to Cllr Barry Rawlings Leader of Barnet Council

Invitation to House of Commons debate on why social workers are voting to strike

Why are Barnet Council Mental Health social workers taking strike action?

Mental Health Social Workers in Barnet have taken 12 days of strike action and another 14 days are planned in the coming months. But Barnet isn’t the only local authority in which social workers are saying enough is enough. Earlier this year South Gloucestershire social workers became the first branch to successfully ballot for strike action with Barnet, Brighton, Swindon and Leeds social workers all having declared strike action in the following months. Similar issues are being raised by strikers across the country including high caseloads, under-staffing, unsafe services, and unfair pay policies.

13 years of austerity have resulted in huge cuts to local authority statutory services while the impact of covid has contributed to increases in referrals to social care that are forecast to continue for years to come. In such an environment and with no clear political priority being placed on fixing social care, this panel discussion considers topics like the role of social workers in championing better public services and fair pay for workers.

The session will be held on 5th December 2023 at 6.30pm in Committee Room 17, House of Commons.

The event is free, and all are welcome but please book your place by emailing contactus@barnetunison.org.uk

Co- Chairs: John McDonnell MP and Kerie Anne

Panellists:

- Kristiana Heapy

- Dan Smart

- Corinna Edwards-Colledge

- Nana Yabbey-Hagan.

Kerie Anne, Chair of UNISON National Social Care Forum, Branch Secretary, Tower Hamlets UNISON and Families social worker.

Corinna Edwards-Colledge is joint branch secretary of Brighton and Hove UNISON and has worked in local government for over 20 years. She is also a campaigner and a writer, and is currently leading adult social workers in Brighton on their very first strike action over pay parity.

Kristiana Heapy Kristiana is the Unison team rep in Barnet’s Mental Health Social Work South Team which is currently undertaking strike action. Kristiana qualified as a social worker in 2022, prior to that she worked in the voluntary sector in a number of public policy, campaigning and service delivery roles. In her spare time Kristiana has held voluntary positions for charities focused on access to green space, equality and supporting people experiencing mental ill-health..

Dan Smart is Branch secretary, UNISON South Gloucestershire and an Adulst social worker.

Nana Yabbey-Hagan is a Qualified Social Worker for Children and Families of 10 years. Nana is currently a Team Manager for a Looked After Childrens Team, previously a Team Manager for a frontline Children Protection Team. In addition, Nana is a Practice Educator for Bachelor’s, Masters, Step Up Students/ASYE assessor for Newly Qualified Social Workers (NQSW), University Lecturer and Co-Host of the Social Worker and The Mentor Podcast.

***Please note Barnet UNISON Mental Health Social Workers are taking a whole week of strike action starting Monday 4 December to Friday 8 December.

You are welcome to join our Festive Barnet UNISON Picket line details of location are below.

End.

Background:

- Open letter to Executive Director of Adult Social Care – Mental Health social work dispute.

- Open letter to Director of Adult Social Care – Mental Health social work dispute.

- Open letter to Cllr Barry Rawlings Leader of Barnet Council

Open letter to Executive Director of Adult Social Care – Mental Health social work dispute.

Dear Dawn

As a registered social worker, you will be aware of the professional standards set out by our regulatory body, Social Work England, and the expectation that social workers should raise concerns about unsafe practice and should challenge practices, systems, and processes where necessary. We implore you to act on your responsibilities within the social work profession and also those set out within the framework of the law.

The Care Act 2014 is underpinned by the responsibility for local authorities to promote wellbeing and to prevent, delay, and reduce a person’s needs for care and support. We have been reporting that we, on the front line, do not feel that we are meeting this statutory responsibility and are concerned about the safety and wellbeing of the residents of Barnet, the impact on ourselves as regulated professionals, and the impact on Barnet Council. Whilst you will be aware, through our consistent reporting, of our areas of concerns, this open letter stresses a number of the key areas:

The Local Government & Social Care Ombudsman consider it reasonable for a person to wait 4-6 weeks for an assessment. In August 2022 we were raising concerns about staffing levels and that our waiting list for an assessment under the Care Act was up to six months. Since then, the situation has continued to become far more critical, with 14 staff members leaving within a year and the waitlist more than doubling. The staff who left were often the staff members with the most experience, many working their entire 20-30 years careers as social workers within Barnet mental health. This means that our teams have been left without an experienced workforce. In one team, figures demonstrate that when looking at the years of mental health experience of permanent staff, the team has lost 75% of the experience in the past year alone. The impact is that our waiting lists have now drastically increased, reaching up to 15 months, and alarmingly continue to grow. Based on rates of increase, without adequate intervention, we predict that the waiting list will reach two years in 2024.

It should be stressed that these are not people with low level needs for whom it is safe to wait for an assessment. People with high and complex needs are frequently waiting up to 15 months. Without adequate support, people with serious mental disorders are at significantly increased risk of deterioration to their mental state. Far too often our work becomes crisis management, which statutory guidance is clear cannot achieve wellbeing. The Care Act emphasises the need to not wait to respond until people reach crisis point and the need to focus on preventing and delaying needs for care and support, which we are not doing.

When people are left to deteriorate, unmanaged risks to their health and wellbeing put them at significant risk of harm, and even death, whilst awaiting an assessment. This is particularly concerning given that the people we work with have serious mental disorders, which already elevates risk. We further see this in complex presentations of self-neglect owing to a deterioration in mental state. It is particularly concerning that people on our waiting list are deteriorating to such a degree that the risks to their health and wellbeing falls under the scope of safeguarding.

On the subject of safeguardings, the London Multiagency Adult Safeguarding Policy & Procedures set out the target timescale for safeguarding enquiry actions as being undertaken within 20 days. However, in Barnet mental health social care we do not always have capacity to even allocate the case to a worker within this timeframe, let alone undertake enquiry actions. The result is that safeguarding enquiries have, at times, become held by duty workers, which we feel is unsafe, or worse yet, left on the waiting list awaiting capacity to be allocated.

Returning to deterioration, we are all too aware that deterioration means that people’s needs are much greater at point of assessment. We do not see leaving people to deteriorate for up to 15 months as being in line with the responsibility to promote wellbeing nor to prevent needs. It also increases the input needed from workers and much time becomes spent working diligently to engage people who are unwell and to work collaboratively to reduce serious risks to the person’s health and wellbeing. Needing to work so intensely with people means that the progress of work is much slower and this subsequently creates further delay in workers having capacity to pick up new cases. This adds yet further pressure to the waiting list.

The Care Act specifically states that reviews should be undertaken, at a minimum, of every 12 months. However, in Barnet mental health social care, people are not receiving regular reviews in line with this statutory requirement. It is rare that we undertake reviews within this timeframe and Mosaic evidences that many people have not had a review in several years, prior even to the existence of the mental health social care teams. Only those who contact social services to request a review are being added to the active waiting list, though they too join the up-to 15 months wait.

Many of the vulnerable people we work with do not have informal carers and their needs are simply going unmet whilst they await input. However, for those who do have informal carers, we have seen that the significant waiting lists are placing high levels of stress on the carers, which is resulting in carer breakdown or carers not being able to engage in areas central to their own wellbeing, owing to increased pressure on their caring role. This too, we feel is not in line with the responsibilities we have for carers under the Care Act.

The Care Act sets out pathways for young people approaching transition to adult services. However, despite children’s services bringing young people to our attention six months prior to their 18th birthday, we do not have the capacity to allocate these young people a social worker and they are not receiving assessments before they turn 18, which is not in line with the Care Act.

We have been told that there is no money within Barnet Council. However, current practice is costing Barnet Council significantly more money than necessary and reorganising of funds would likely be beneficial in helping to achieve responsibilities under the Care Act. For example, as people are being left to deteriorate for up to 15 months, their needs for care and support are increasing. The subsequent increased packages of care and placements in care homes costs Barnet Council more money than timely care and support that reduces, delays, and prevents a person’s needs. The fact that we are not able to undertake timely reviews means that people who were placed in supported accommodation or care homes as a temporary measure are not receiving input to step them down and promote their independence. This too means Barnet Council is paying for more care than needed, often for many years, at which point the person has become dependent on this care.

As people with severe mental ill-health are not receiving the support they need to remain well and live in the community, they are at increased risk of avoidable, or delayable, deterioration to mental health, which can result in the person’s compulsory admission to mental health hospital. This too has financial implications for Barnet Council in regard to the increased need for Mental Health Act assessments undertaken by Approved Mental Health Professionals. Furthermore, if a person is compulsorily admitted under relevant sections of the Mental Health Act, Barnet Council has financial responsibilities to meet the person’s needs under S.117. Again, as these are not being regularly reviewed, Barnet Council is overspending on care which should not be necessary.

We have been told that there are similar issues across adult social care. However, we have been informed by our colleagues in the non-mental health social care teams within Barnet Council that their waiting lists are nowhere near 15 months. In the absence of any statistics provided by Barnet Council we have no other option than to resort to anecdotal evidence. We have also spoken with our social work colleagues in other London Boroughs who also inform us that their waiting lists are nowhere near 15 months, with one worker, who left Barnet this year, informing us that the waiting list at the London council she now works for is only up to 6 weeks.

The remaining staff are desperately trying to plug the gaps and the result is a significant impact on staffs’ own wellbeing, with staff reporting poorer physical and mental health. When surveyed, 100% of staff who responded stated they had considered leaving the service. We remain deeply concerned for the vulnerable residents of Barnet who we serve, and continue to challenge the lack of a safe service and the unreasonable and increasing waiting lists which put Barnet residents at risk of harm, and even death. We feel that Barnet is not meeting its statutory responsibilities and we are asking for a means to provide a stable, experienced, and permanent workforce. To do this, we are asking for a reasonable recruitment and retention payment, already in place for Family Services, to promote staff to remain in Barnet rather than leave for better paid and lower stressed positions. We ask that you please engage in negotiations so that we may all come together to meet our statutory responsibilities and the needs of Barnet residents.

Yours sincerely,

Barnet Mental Health Social Workers

Open letter to Director of Adult Social Care – Mental Health social work dispute

Dear James Mass,

We are writing to you today, in the absence of any response to us so far, following our 9 days of strike action. We are deeply disappointed that you have chosen not to acknowledge the strike and, in many ways, feel that we are being treated with contempt. It unfortunately feels in keeping with a wider dismissal of the distress workers have voiced to you in the past 18 months of this dispute. We have always appreciated that in Barnet, senior management regularly interact regularly with practitioners. However, when coupled with the contrast of complete silence during our strike action, the inevitable result has been a deep sense of alienation, frustration and undervaluation.

The past 18 months, and the 14 staff members who have left our teams, demonstrate the dangerous potential of this undervaluation. 1 staff member has already handed in their notice since strike action began, more have formal plans to leave and anecdotally many others have expressed that the lack of response from senior management means they are seriously considering whether to stay. Put simply, your silence has led staff members previously very committed to Barnet to feel that they are in a service which does not make an effort to recognise their worth to the council or the difficulties they are bringing to your attention. We are incredibly concerned about the current recruitment and retention crisis spiralling out of control, leaving remaining social workers unable to provide a service at all, let alone one which is safe for service users and the social workers of whom we have been bereft of since the transformation of mental health social care in 2021. We are therefore urging you to commit to meeting with our representatives and engaging in meaningful dialogue about how we can resolve this situation.

The absence of any negotiation leaves us to reflect on previous responses from you to the conditions which led to this dispute.

We feel dismissed when you deny that our service is in crisis when it is us as practitioners who have to deal with the realities of an up to 15-month waiting list for individuals in mental distress. We are the practitioners assessing individuals whose needs have clearly deteriorated since their referral; who are either referring for Mental Health Assessments or undertaking these assessments at much higher numbers and who are putting in care as urgent hospital discharges for people who have been on our waiting list for months prior to their admission. We know first-hand that this means the care we need to put in place is much more significant than if we had been able to support them closer to their referral. We also know that we are in no position to regularly review and reduce this care, to provide least restrictive support, due to the number of service users needing acute, crisis interventions. Quite simply, unless individuals are presenting in crisis, we are unable to prioritise their care. It is subsequently difficult not to feel that we are in a failing service.

It was therefore also a profound insult to be told that that there is no retention crisis after 14 valued staff members (2 more social workers have handed in their notice since the strike began) , many of whom have been in Barnet for years, have left and told us this resulted from intolerable stress of being part of such a struggling service. We know that current conditions lead to intense anxiety, low satisfaction with work and a pressure to overwork, as quite simply; this is our daily reality. We know this is a recipe for burn-out and that when faced with burn-out, practitioners vote with their feet and leave the service. Subsequently, it is bordering on offensive to dismiss these conditions during a time when the council wishes to prioritise employee well-being as demonstrated by the communication on Mental Health Awareness day. We know the jobs practitioners have taken when leaving Barnet: these are better paid and more adequately resourced/staffed both in and outside of the statutory sector. Barnet has been a big proponent of the Think Ahead graduate scheme as a means of training social workers and encouraging them to stay in Barnet. Yet in the last two years, half of one cohort and 2 out of 5 of the current cohort will have left less than 6 months after finishing their ASYE. This scheme is failing because participants do not want to remain in a service with the current level of stress and chaos. We urge you to listen and prioritise the voices of the social workers that you employ over your own statistics to understand this retention crisis and the way out of it.

It was yet more disappointing to see that you felt our announcement of strike action was asking for special treatment for mental health social workers and pitted us against other social workers and Occupational Therapists in the council. This could not be further from the truth. We value highly the work of our colleagues in Adult Social Care, many of whom shared invaluable knowledge during the transformation to fill the gap of any targeted training for practitioners previously working outside of statutory teams. You are aware of the context for our organising and its genesis in this transformation which initiated our destabilising turnover and resulting spiralling waiting list. To deny this and again attempt to stoke division within social care perpetuates a sense that we have not been listened to. Throughout the dispute we have encouraged other social workers and OTs to take action if they are experiencing similar recruitment and retention problems and will continue to do and support them if they wish to organise. If this does take place, we urge you to learn from our current dispute and engage in the meaningful negotiation that we attempted over and over again prior to our strike action to prevent further disruption to social care.

Not one social worker out on strike wants to be in this position. The decision to strike, and to continue striking, is one which brings intense anxiety given that we know our own workloads, waiting lists and stress levels increase with each day that we are withdrawing our labour. We are in this profession because we want to support vulnerable people experiencing mental distress. You have seen how passionate we are about this work, in reviewing our care plans for panel and shadowing us on visits. You know then, that to take time away from this work is a last resort. However, it is this same commitment and value-base which has made us feel that striking is a necessary extension of our advocacy for service users who are not receiving the standard of care they need.

Each day we are out on strike we are hoping that you will meet with our UNISON reps in order to secure a resolution that will bring this dispute to a close.

Yours sincerely,

Barnet Mental Health Social Workers

End.

Open letter to Cllr Barry Rawlings Leader of Barnet Council

Dear Councillor Rawlings,

We are Barnet UNISON Mental Health Social Workers. Mental Health Social Workers have taken 9 of 32 announced strike dates. We took strike action as a last resort after 18 months of trying to negotiate with senior managers at Barnet Council about concerns that mental health social work services are not able to run at a safe level because there are not enough social workers, particularly experienced social workers, to meet rising demand. As a consequence, waiting lists continue to rise to dangerous levels and burnt-out staff are leaving for better paid social work roles in universities with no statutory responsibility, or better paid specialist roles in the NHS. In the last 12 months 14 permanent and locum mental health social workers have left their roles, in addition since the strikes began 2 more social workers have since handed in their notice taking the total to 16 social workers or 66 % of social workers, will have left in the space of one year. Furthermore, locums who come and go in a short period of time can also negatively impact people with mental ill-health who benefit from consistency and the trust they are able to build with the professionals they work with.

We recognise the context of 13 years of a Tory government which has taken a scythe to vital public services. However, Barnet Labour Council cannot hide behind this fact to abstain themselves from any responsibility for providing a safe mental health service in Barnet. In 2022 when Barnet Labour took an absolute majority in Barnet for the first time in almost 50 years, you said that you would work with residents to “make big changes to the borough”. For mental health social work services those changes have meant a waiting list in community mental health services that has grown from about 4 months to 15 months and a staff retention crisis.

Barnet Labour were elected on a manifesto pledge to “champion good mental health and increase a Barnet Charter for Mental health”. This sounded promising but in reality, this new charter was launched without any input or discussion with community mental health social workers, on a day when mental health social workers were picketing the same building.

We have been disappointed in Barnet Labour Council’s response to our strike. We have seen quotes given to media from councillors which parrot the same line that senior managers have been telling Barnet UNISON for 18 months. Repeating false claims that there isn’t a recruitment and retention issue in mental health social work. These are claims for which we have repeatedly and consistently asked senior managers to provide evidence, but none has been forthcoming. It is examples like these which Barnet Labour must take responsibility for and should not be hiding behind the inadequacies of central government mismanagement.

As a Labour Council we ask for you to show solidarity with not only UNISON members who deserve fair pay but more importantly Barnet residents who deserve a safe service and no waiting lists. We are asking for your help to bring an end to this dispute, reverse the decline in mental health social work services and make Barnet an example that other local authorities can aspire to emulate.

We are asking for a meeting with you to discuss how we can achieve this.

Yours sincerely,

Barnet UNISON Mental Health Social Workers.

National Disability History Month 16th November to 16th December

Dear Barnet Group Unison member,

Do you have a disability?

If so, have you ‘declared’ it to the employer?

If you haven’t, please consider doing so – the employer can’t make reasonable adjustments in line with the Equality Act 2010 if they don’t know that you have a disability or condition.

It is really easy to ‘declare’ a disability – go to ITrent – click ‘view profile’ – under ‘confidential information’ click on ‘sensitive information’ – scroll to the bottom of the page and populate ‘self-certified disabled’ and ‘Disability description’ – and that is it – should your disability become an issue that you need a bit of help with, you would have ‘declared’ the disability/condition and the employer has to recognize that you may need to have reasonable adjustments put in place to help you.

Please consider declaring your illness/disability/condition – there is no stigma – I speak as someone with a long-term mental health issue [depression] who has declared their disability to the employer – the declaration is in complete confidence – and the help that I received and still receive to ‘manage’ my depression was only possible because my disability had been declared.

I have a disability – I am not disabled.

In solidarity

Patrick

Patrick Hunter

Barnet UNISON Assistant Branch Secretary for The Barnet Group

UNISON National Disability History Month event

27 November 20236:00pm–8:30pm

We’re holding a national event to celebrate Disability History Month and we’d love it if you could make it to London for it – or join us online!

The event will see the launch of our campaign for a new two-week deadline for reasonable adjustment requests. It takes place from 6pm on Monday 27 November at the UNISON Centre in London.

We’ll have some great speakers including Dr Marie Tidball, Labour parliamentary candidate for Penistone & Stockbridge and Bruce Robin, UNISON Legal Officer. There’ll also be a reception afterwards and a chance to speak to other disabled members about the campaign.

If you need support if you would like to travel to the event. Please contact the Barnet UNISON office at Contactus@barnetunison.org.uk

You can also join online –

Links to register:

Register to attend in person in London – https://msg.unison.org.uk/c/1cnOYMhTK8gpqoyeWiUQMPN

Register to attend online – https://msg.unison.org.uk/c/1cnOZPeco4t24WVFRdXuObY